You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Solar Panel Discussion

- Thread starter Tee2

- Start date

Help Support Toyota Rav4 EV Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

dstjohn99

Well-known member

Be careful which SDGE rate you sign up for. Also remember that when you switch rates you are locked in for 12 months.

I completed my spreadsheet analysis based on 1) the past year's electric usage data in 15 minute intervals and 2) electric usage since owning my Rav4 EV (2 months). Aside from the 3 weeks or so of rate shift for daylight savings time (SDGE DST does not match current DST, so they must make an adjustment), and not adjusting for holidays the spreadsheet calcs are spot on.

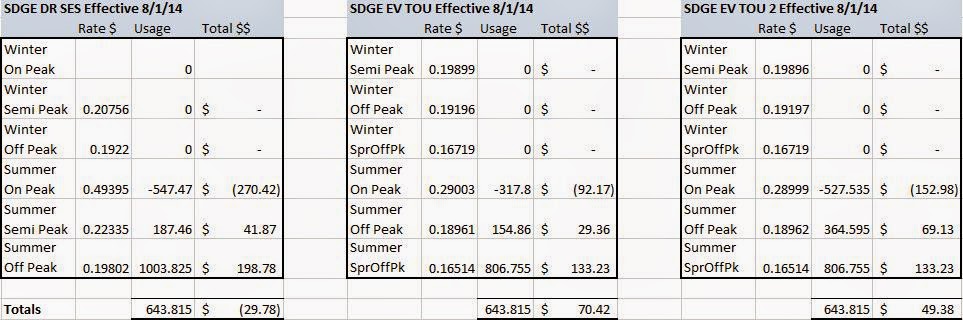

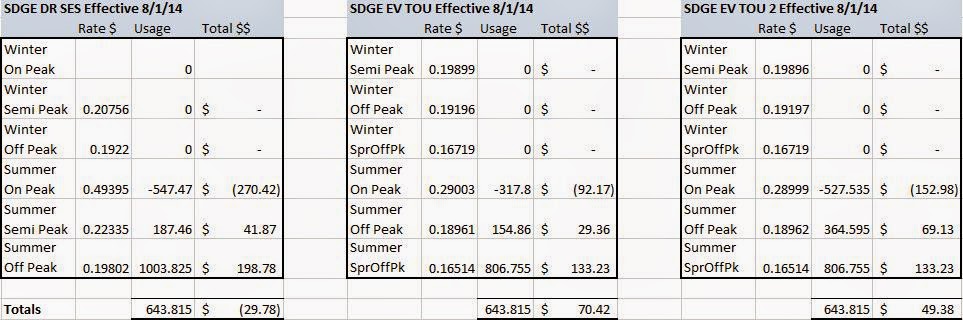

The rates I compared were SDGE DR-SES, EV TOU and EV TOU2. The EV rates are much lower than the DR-SES for peak and about 3 cents lower semi-peak / super off peak. The EV rates are probably the best if you do not have solar AND can benefit from TOU metering. HOWEVER, if you do have solar you need to look very carefully at your excess generation times, overall usage, etc.

For my suituation I found that the DR-SES saves me $80 to $100 over the two months I've had the EV:

Since I have significant excess production during the Peak hours, I get the maximum credit ($.49/kWh - Summer instead of $.29) with the DR-SES. That way I can use the credits to offset the cost of much more power during off-peak times like charging my car - even though I'm paying $.03/kW more than the EV rates during the off-peak times. Also my off-peak time is 10pm - 6am instead of midnight to 5am. The on peak rate is 20 cents higher but it's also 11am - 6pm (best solar production) instead of 12pm - 8pm / 12pm - 6pm.

For the entire year's data (2 months with car) I show a 2582kW surplus generation. With DR-SES I have a ($1277) credit ($113 payout if not used). With EV TOU it is ($760) and EV TOU2 is ($812). So I can buy $465 to $517 more electricity than the other rates.

I did not compare the standard tier rate(s), but I can add it if someone is interested.

I hope this helps. By the way, the spreadsheet logic formulas were challenging. I never would have succeeded without miimura's spreadsheet as an example - Thank you.

I completed my spreadsheet analysis based on 1) the past year's electric usage data in 15 minute intervals and 2) electric usage since owning my Rav4 EV (2 months). Aside from the 3 weeks or so of rate shift for daylight savings time (SDGE DST does not match current DST, so they must make an adjustment), and not adjusting for holidays the spreadsheet calcs are spot on.

The rates I compared were SDGE DR-SES, EV TOU and EV TOU2. The EV rates are much lower than the DR-SES for peak and about 3 cents lower semi-peak / super off peak. The EV rates are probably the best if you do not have solar AND can benefit from TOU metering. HOWEVER, if you do have solar you need to look very carefully at your excess generation times, overall usage, etc.

For my suituation I found that the DR-SES saves me $80 to $100 over the two months I've had the EV:

Since I have significant excess production during the Peak hours, I get the maximum credit ($.49/kWh - Summer instead of $.29) with the DR-SES. That way I can use the credits to offset the cost of much more power during off-peak times like charging my car - even though I'm paying $.03/kW more than the EV rates during the off-peak times. Also my off-peak time is 10pm - 6am instead of midnight to 5am. The on peak rate is 20 cents higher but it's also 11am - 6pm (best solar production) instead of 12pm - 8pm / 12pm - 6pm.

For the entire year's data (2 months with car) I show a 2582kW surplus generation. With DR-SES I have a ($1277) credit ($113 payout if not used). With EV TOU it is ($760) and EV TOU2 is ($812). So I can buy $465 to $517 more electricity than the other rates.

I did not compare the standard tier rate(s), but I can add it if someone is interested.

I hope this helps. By the way, the spreadsheet logic formulas were challenging. I never would have succeeded without miimura's spreadsheet as an example - Thank you.

dstjohn99,

As far as I know, with Solar, you end up on Netmeetering and tiered pricing. I didnt know you could have Solar and choose TOU.

Unless your not producing enough and you have more 200+kwh a month of usage from SDGE then it could make sense to switch to TOU. but at 14 cents for the first 200kwh, tiered pricing is the way to go. I thought it was the only way to go.

As far as I know, with Solar, you end up on Netmeetering and tiered pricing. I didnt know you could have Solar and choose TOU.

Unless your not producing enough and you have more 200+kwh a month of usage from SDGE then it could make sense to switch to TOU. but at 14 cents for the first 200kwh, tiered pricing is the way to go. I thought it was the only way to go.

dstjohn99

Well-known member

Conan said:dstjohn99,

As far as I know, with Solar, you end up on Netmeetering and tiered pricing. I didnt know you could have Solar and choose TOU.

Unless your not producing enough and you have more 200+kwh a month of usage from SDGE then it could make sense to switch to TOU. but at 14 cents for the first 200kwh, tiered pricing is the way to go. I thought it was the only way to go.

There are many rate plans available. I'm no expert as to which are (or are not) available for residential net-metering, but I have looked at the most relevant. The complete list is here http://www.sdge.com/total-residential-electric-rates.

On the tiered system your solar production shaves off the higher cost energy, no matter what time you use or produce. The more you make the less you save in this scenario - when solar prodcution offsets your usage at the lower tier rates. For those that cannot over-produce during peak hours this is likely the best return for the investment without zeroing usage, but just reducing cost. With this scenario the return on investment for solar energy diminishes as your overall usage is reduced into the first tier, since your not saving as much for this lower rate energy. With the tiered rates, in order to zero your bill you need to also zero your usage.

For time of use, if you overproduce 100kW during peak period that credit provides 200 - 250 kW of power off peak (or in the winter) for free (SES summer rates). Therefore your solar system yields more than it produces. This can effectively zero the cost of electricity while producing less electricty than you actually use. With EV TOU rates, overproducing 100kW during peak period offsets the cost of only 150kW during off-peak.

As EV's become more mainstream energy usage will increase, especially during off peak hours. Somehow the above TOU scenario seems unlikely to continue indefinitely. But it is likely viable for the next 5 - 10 years.

dstjohn99

Well-known member

By the way, has anyone looked at the SDGE schedule DR-TOU rates? It looks like it is the same as a tiered rate, except you pay up to 62 cents per kW at peak times. Why would anyone sign up for that? There are no apparent savings for off-peak usage.

dstjohn99 said:By the way, has anyone looked at the SDGE schedule DR-TOU rates? It looks like it is the same as a tiered rate, except you pay up to 62 cents per kW at peak times. Why would anyone sign up for that? There are no apparent savings for off-peak usage.

Since this thread is about solar I will say 62 cents is a great price to sell your excess solar power produced on-peak.

$114.70

$133.89

MAXLINER Floor Mats 2 Row Liner Set Black for 2006-2012 Toyota RAV4 Without 3rd Row Seat

AutoAccessoriesGarage

$87.69

Toyota Genuine All-Weather Floor Mats for 2007-2012 Rav4-Set of 4, New, OEM,

parts.elmhursttoyota com

dstjohn99 said:By the way, has anyone looked at the SDGE schedule DR-TOU rates? It looks like it is the same as a tiered rate, except you pay up to 62 cents per kW at peak times. Why would anyone sign up for that? There are no apparent savings for off-peak usage.

Thats what I was trying to say.

smkettner said:dstjohn99 said:By the way, has anyone looked at the SDGE schedule DR-TOU rates? It looks like it is the same as a tiered rate, except you pay up to 62 cents per kW at peak times. Why would anyone sign up for that? There are no apparent savings for off-peak usage.

Since this thread is about solar I will say 62 cents is a great price to sell your excess solar power produced on-peak.

SDGE buys your solar surplus at wholesale pricing which is about 3.9 cents a kwh.

bottom line, you dont want to be producing less or more than your usage. Ideally, you want to break even. Selling it at $0.039kwh wont recoup the cost of the hardware for 20 years. Also, theres a 5 dollar "connection fee" SDGE charges monthly.

You mean surplus at the end of the year? Or each hour you get 3.9 cents credit for what you produce over consumption?

I run a large annual deficit. SCE does give credit for the on-peak TOU rates close to 49 cents in Summer. I use a lot of off-peak at 9 cents and the money comes out close to even.

First four months I have net used 2902 kWh and have a credit rolling forward of $8 to be used in Winter.

I understand SDGE is fairly similar.

I run a large annual deficit. SCE does give credit for the on-peak TOU rates close to 49 cents in Summer. I use a lot of off-peak at 9 cents and the money comes out close to even.

First four months I have net used 2902 kWh and have a credit rolling forward of $8 to be used in Winter.

I understand SDGE is fairly similar.

dstjohn99

Well-known member

EDIT: I see the catch, the .62/kW only applies to usage above 200% of baseline, so a typical solar user will never see the credit at $.62, rather the typical peak credit would be reduced to 18 or 19 cents. Not a good idea.

If it's available to net metering customers, that's true. The hours for peak / off peak rates are the same as the DR SES schedule. It says experimental rate in the Tariff book information sheet. Maybe I need to check into this one too. Then I could charge a second car for free.

smkettner said:Since this thread is about solar I will say 62 cents is a great price to sell your excess solar power produced on-peak.

If it's available to net metering customers, that's true. The hours for peak / off peak rates are the same as the DR SES schedule. It says experimental rate in the Tariff book information sheet. Maybe I need to check into this one too. Then I could charge a second car for free.

smkettner said:You mean surplus at the end of the year? Or each hour you get 3.9 cents credit for what you produce over consumption?

I run a large annual deficit. SCE does give credit for the on-peak TOU rates close to 49 cents in Summer. I use a lot of off-peak at 9 cents and the money comes out close to even.

First four months I have net used 2902 kWh and have a credit rolling forward of $8 to be used in Winter.

I understand SDGE is fairly similar.

Its year end. At the end of the year... if you have generated more power than you consumed, you will sell those kwh's at 3.9 cents each. If you have generated less than you consumed... then I believe they calculate it per month and charge you based on your tier usage. I could be wrong about that part but I know that its 3.9 cents if you sell it back to them.

rickrides

Well-known member

I checked my smart meter Wednesday as I do a few times per week and I noticed the voltage now reads 248v instead of 238 or 239v. I guess this is how PG&E raises their rates without anyone noticing. For a given resistance a higher voltage will increase current and wattage...Ohm's law. :evil:

Bassman

Well-known member

Getting ready to install a 15,400 watt LG 275 watt panel - Enphase M-250 system over the next month. I'm doing the install and it's only costing me about $35,000 total. I'm tired of paying PG&E $300 to $400 a month and I want to irrigate my pastures. This will cover my house, charging of both EVs and allow me to run my well pump to irrigate during the Summer. Plus it will still give me a little extra watts at the end of the year. My EV-9B rate will stop at the end of December, so I'm trying to figure out whether the EV-A rate is better than the E-6 rate or not.

dstjohn99

Well-known member

Bassman said:My EV-9B rate will stop at the end of December, so I'm trying to figure out whether the EV-A rate is better than the E-6 rate or not.

You definitely want to download your smart-meter data and use miimura's spreadsheet to analyze the different rates based on your data. See earlier in the thread for links to the spreadsheet.

Hi

I recently talked to Solar City about installing a 5.5 KWh system and it was very interesting. They offed me 2 choices. Either a 20 year lease option for my north facing roof or a 30 year purchase option for the South exposure. The north exposure gets me 75% and the south gets me 87% efficiency. The purchase option gets me the 30% tax credit so I want to work that if possible.

The problem I have is I would rather put the panel in the back of the house (North) but would also rather buy than lease so I haven't found the ideal yet. I have some Solar City techs coming early next week so maybe we can figure out something.

Any thoughts on this from you solar folks? Any of you use Solar City before?

thanks

I recently talked to Solar City about installing a 5.5 KWh system and it was very interesting. They offed me 2 choices. Either a 20 year lease option for my north facing roof or a 30 year purchase option for the South exposure. The north exposure gets me 75% and the south gets me 87% efficiency. The purchase option gets me the 30% tax credit so I want to work that if possible.

The problem I have is I would rather put the panel in the back of the house (North) but would also rather buy than lease so I haven't found the ideal yet. I have some Solar City techs coming early next week so maybe we can figure out something.

Any thoughts on this from you solar folks? Any of you use Solar City before?

thanks

I called solar city when I first started looking. At the time they were only offering leases in California and after doing a lot of research I concluded they were the worst out there with regards to price. if I wanted to pay cash for a system from them they quoted me about $33k for a 7.5 kW size, and they wanted me to assign them all my rebates. I asked why they should get the rebates and they said they were fronting me the rebate money in the form of a discounted system. $33k for a 7.5kw array seemed rather steep, and all the equipment was cheap Chinese stuff.

In any case after getting my financing in order and doing a lot more research I decided to go with Andalay Solar's AC quick connect panels. Each panel has the inverter and grounding wires already assembled into the unit so the panel outputs house ready AC current. A 9.6kw system should be enough to offset my whole house and the Rav4, and it's the same price that solar city quoted but I get to keep all the rebates.

In any case after getting my financing in order and doing a lot more research I decided to go with Andalay Solar's AC quick connect panels. Each panel has the inverter and grounding wires already assembled into the unit so the panel outputs house ready AC current. A 9.6kw system should be enough to offset my whole house and the Rav4, and it's the same price that solar city quoted but I get to keep all the rebates.

I went with Solar City. I purchased the system. Yes I assigned the small CA rebate over to them. You get the direct credit immediately and I am sure Solar City gets a small amount more based on actual production vs the estimated production formula. Difference cannot be huge. CA rebate website explains all this. Took the 30% Federal myself.

Yes Solar City was a bit more money. They also handled the city and associations approvals with ease.

First hand knowledge of other low bids getting delayed and reconfigured smaller due to unforeseen limitations and regulations. And extended association delays for aesthetic reasons that needed mitigating. All at increased cost.

Once approved, Solar City had the actual work done in one day with no hassle or issues. I rate them top notch as a contractor. No follow up issues. Came back as stated to complete some final issues without a single reminder.

Yes Solar City was a bit more money. They also handled the city and associations approvals with ease.

First hand knowledge of other low bids getting delayed and reconfigured smaller due to unforeseen limitations and regulations. And extended association delays for aesthetic reasons that needed mitigating. All at increased cost.

Once approved, Solar City had the actual work done in one day with no hassle or issues. I rate them top notch as a contractor. No follow up issues. Came back as stated to complete some final issues without a single reminder.

Thanks !

I should be getting a formal design plan from Solar City is a day or two. I"m leaning towards a purchase versus a lease. They seem professional and expensive but I'm looking for a no hassle turn key set up. Didn't know about the CA rebate. I'll have to look into that more.

I wonder if I sell later what kind of return I might get with solar. Anyone have some history on that?

I should be getting a formal design plan from Solar City is a day or two. I"m leaning towards a purchase versus a lease. They seem professional and expensive but I'm looking for a no hassle turn key set up. Didn't know about the CA rebate. I'll have to look into that more.

I wonder if I sell later what kind of return I might get with solar. Anyone have some history on that?

miimura

Well-known member

If you are served by PG&E, there are no more solar rebates. People up here have done so much solar that the program was exhausted. Of course, you can still get the 30% federal tax credit if you purchase. If you do PPA or Lease, then the tax credit goes to the "owner", which is not you.

TonyWilliams

Well-known member

miimura said:... you can still get the 30% federal tax credit if you purchase. If you do PPA or Lease, then the tax credit goes to the "owner", which is not you.

Yep. Don't get caught in the trap of leasing AND claiming a 30% tax credit.

Similar threads

- Replies

- 11

- Views

- 404

- Replies

- 1

- Views

- 144